Can’t-Miss Takeaways Of Tips About How To Buy Futures And Options

The futures contract also specifies the number of units of the underlying asset that will.

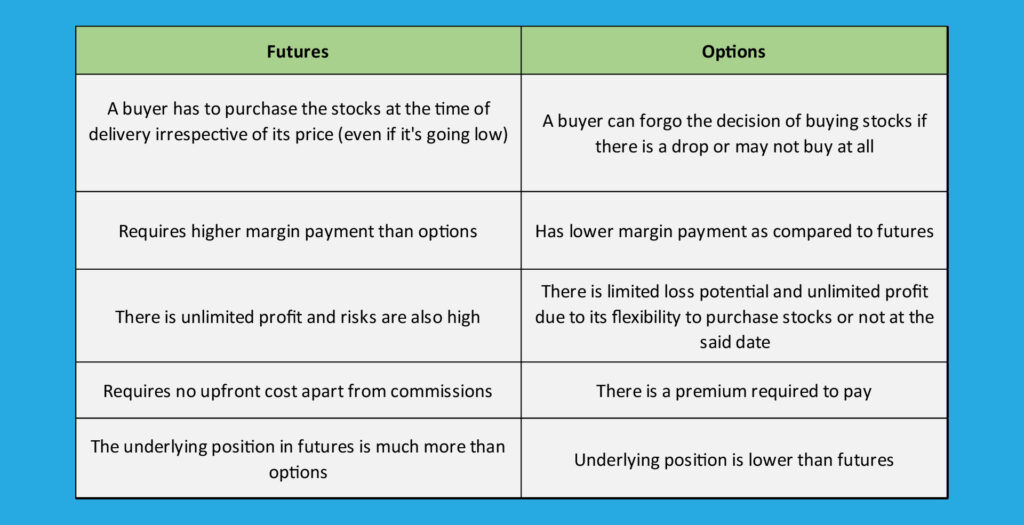

How to buy futures and options. The put buyer may also choose to exercise the right to sell at the strike. Conversely, we incur a $1,250 loss if we get stopped out. A futures contract is the obligation to buy or sell an asset at a specific price and date.

Generally, you'll place an order for futures the same way you would place an order to buy stock or any other equity. Low cost for 16th year in a row 3. If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264).

Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price specified in the option contract. Ad tools that can create, optimize, & automate any futures trading strategy. Using an online trade ticket for futures, enter the underlying symbol to find and select the specific futures contract you want to trade, then confirm the order details and submit the order.

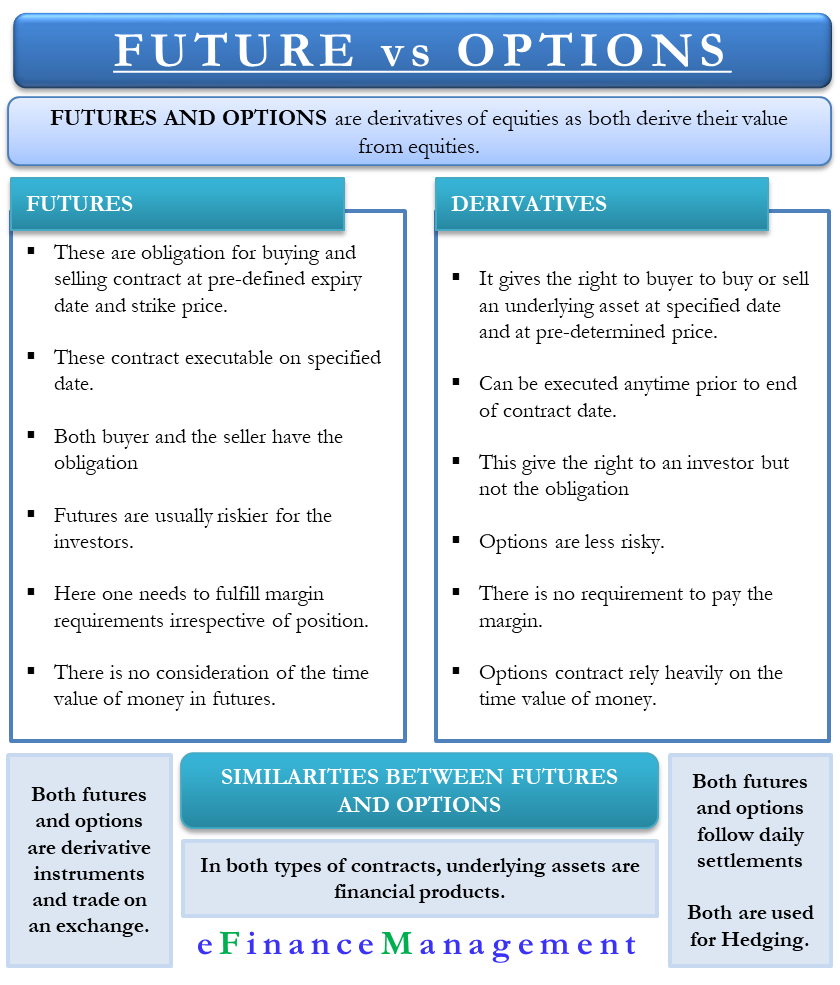

An investor would buy a put option if they expected the underlying futures contract price to move lower (decrease by the sell date). Futures contracts are derivative contracts that derive their… what are over the counter (otc) options. This is done by buying the option, in the case of the writer, or selling the option, in the case of the buyer.

They constitute the derivatives segment of the markets. Futures and options are a type of trading tool for short term trading in the financial markets. Buying the future requires putting up an initial margin of $8,350;

For example, if you buy a united states 12. An options contract gives an investor the right, but not the obligation, to buy (or sell) shares at a specific price at any time, as long as the contract is. Interactive brokers offers two simple, low cost pricing plans for us futures and futures options.

:max_bytes(150000):strip_icc()/dotdash_Final_Open_Interest_Sep_2020-01-d263b95fe77a43ba8ede1b52131318f5.jpg)